- Gorilla Capital

- Posts

- AutoZone

AutoZone

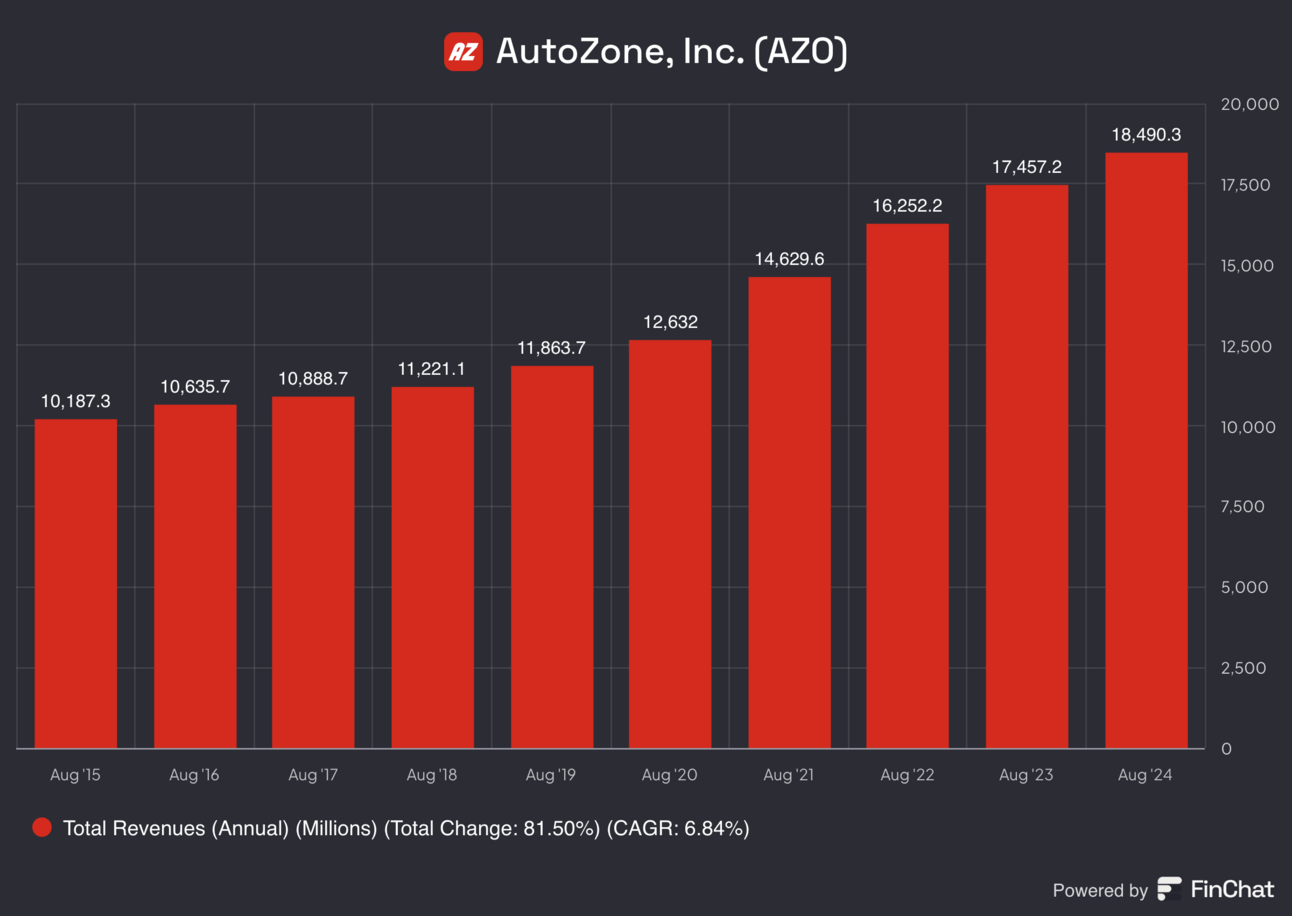

In my last post, I hinted at covering a company with impressive financials: a 9.65% CAGR in net income, a 6.37% CAGR reduction in share count, and an extraordinary 30% average ROIC over the past decade. If you guessed AutoZone, give yourself a round of applause! I’ll admit, before diving into the industry, I’d never have guessed that such a gem was hiding in the auto parts sector.

But here’s the real question: what’s AutoZone’s secret sauce? Achieving a consistent 30% ROIC isn’t easy, so there must be something exceptional under the hood. Let’s explore what truly drives this powerhouse retailer.

Here’s the roadmap for our deep dive into AutoZone’s business:

AutoZone Business Overview: Beyond The Basics

Competitive Position: Analyzing Market Advantages and Challenges

Capital Allocation and Management Incentives: Are They Optimizing Shareholder Value?

Pre-Mortem Analysis: Identifying Risks Before They Happen

Final words

AutoZone Business Overview

AutoZone (AZO) has built its reputation as a leading retailer and distributor of aftermarket automotive parts and accessories since it began operations in 1979. Today, it boasts a network of 7,353 stores across the U.S. (6,432 locations), Mexico (794), and Brazil (127). Each store is a one-stop shop for automotive needs, offering everything from engines and fuel pumps to floor mats and air fresheners, catering to a diverse range of vehicle types, including cars, SUVs, vans, and light-duty trucks.

Around 80% of AutoZone’s sales come from everyday consumers—DIY-ers tackling their own repairs. The remaining 20% is driven by its commercial sales program, which provides credit and rapid parts delivery to repair shops, dealerships, service stations, and fleet owners nationwide. This dual approach has positioned AutoZone to meet the needs of both individual enthusiasts and the professional automotive repair industry.

AZO Revenue Growth